We’ve known this was coming, for a very long time.

For well over a decade, various experts have been warning governments and industry about global over-reliance on China for the supply of rare earth elements (REE). Now, this day of reckoning has arrived.

Beginning in the spring of 2023, China first “threatened” to impose restrictions on the export of some rare earths. Just recently, China passed a law that could reduce its exports of critical REE.

However, you don’t have to be Chinese to see “crisis” and “opportunity” as being two sides of the same coin. Fortunately, a number of mining companies (outside of China) have heeded previous REE warnings and focused their energies on developing rare earth assets.

One of these companies, Appia Rare Earths and Uranium Corp (CSE:API / OTCQX:APAAF), holds multiple REE and uranium projects, with three taking precedence due to their world-class mineralization. Notably, one already holds a defined resource estimate for both REE and uranium. More on this later – REE and their commercial importance.

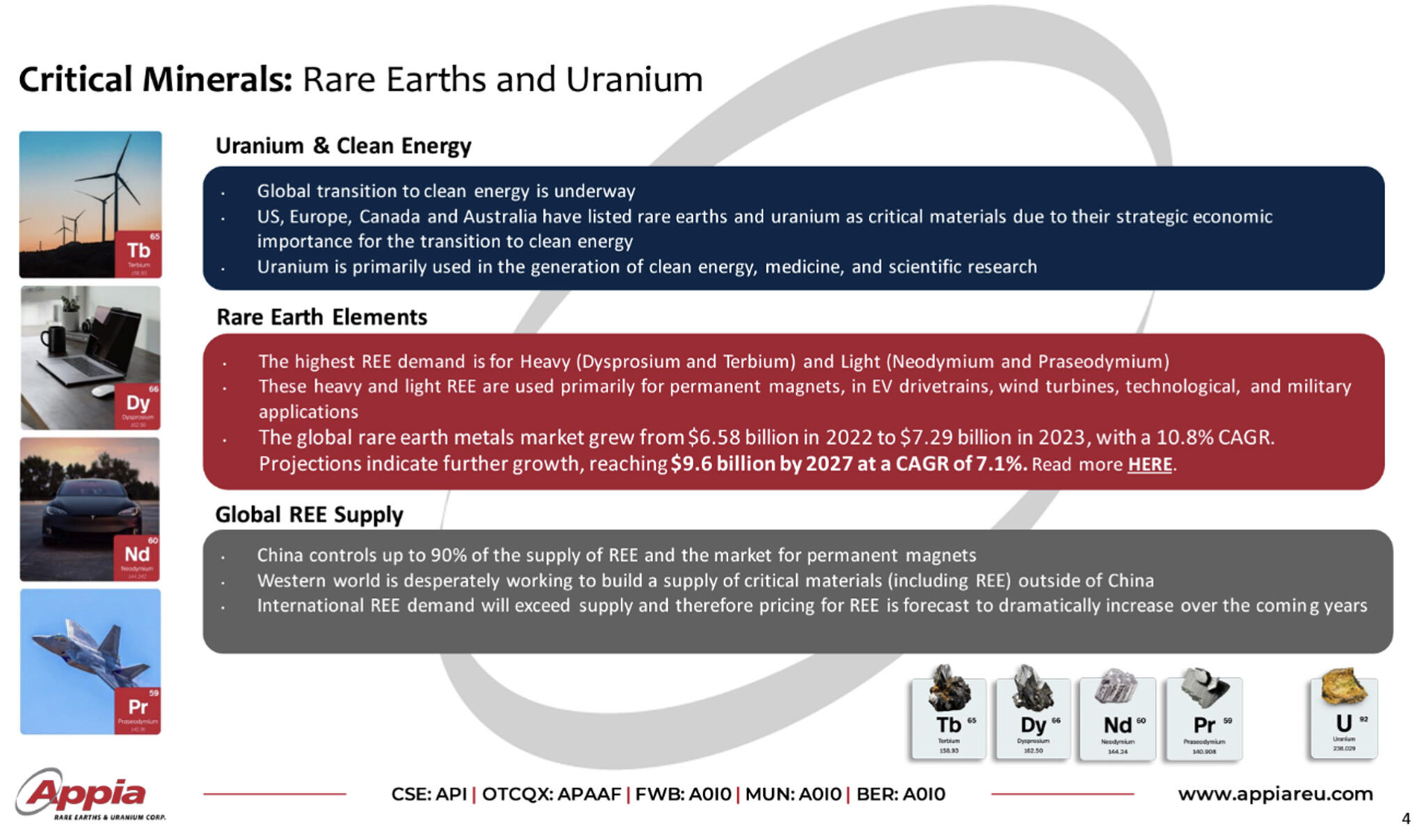

Before discussing new investment opportunities with rare earths, many investors will need some further education.

What are rare earths? What is their principal use/importance in industry? Once those questions are answered, the significance of China’s export restrictions comes into focus.

The term “rare earth element” is a misnomer, in some respects. Rare earths are, in fact, metals. And they are not actually that rare.

The 17 REE (if scandium is included) are ~200 times more abundant than gold. However, what is rare is to find these REE in sufficient concentrations to permit commercial extraction.

Rare earths are divided roughly equally into light rare earth elements (LREE) and heavy rare earth elements (HREE) based upon their atomic mass, with gadolinium classified as either an LREE or HREE.

In terms of investment opportunities with rare earth elements, this can be summarized with one word: magnets.

Because of their impressive chemical and metallurgical properties, REE have numerous unique applications in both hi-tech and low-tech. These include:

- Clean energy generation

- Lasers

- Phosphors

- Chemical catalysts

- Polishing compounds

- Glass and ceramics

- X-ray tubes

- Data storage

- Numerous hi-tech military applications

In many cases, there are few or no substitutes for REE in the manufacturing of these other products. However, these are generally not large markets for rare earth elements.

The reason that magnets, specifically high-performance permanent magnets, dominate the global market for rare earths can also be summarized in one word: scale.

This becomes apparent once readers become aware of how useful and important these high-performance magnets are. They are essential components of all electric motors, such as those in electric vehicles and wind turbines.

These high-performance magnets, or “super magnets” are also used in most high-end electronics – such as smartphones. In short, these high-performance magnets are used in much of our daily lives.

How A Potential Crisis Becomes An Opportunity

Generally speaking, it is the heavy rare earths (HREE) that are most useful in the production of these high-performance magnets, specifically dysprosium (Dy) and terbium (Tb).

However, two of the LREE are also used extensively in the production of these super magnets: neodymium and praseodymium. Neodymium (Nd) is used to make the strongest magnets, while praseodymium (Pr) can often be substituted for neodymium.

These four rare earths comprise the main magnet rare earths (MRE) that are needed to be produced at a large scale. That’s how the global rare earths market looks in terms of demand.

Then there is the supply of rare earth elements. Here is where the scarcity of REE enters into the equation.

The HREE are decidedly rarer than the LREE. For companies developing rare earth projects, this means that the HREE content in rare earths deposits is viewed as a key factor in project value.

With rare earth elements also being essential ingredients in many high-end military technologies, this explains why a rare earths (supply) “crisis” has been regarded as such a serious issue.

One person who sees the current scenario much more in terms of an opportunity than a crisis is REE industry expert, Jack Lifton. Lifton has previously been quite outspoken on this subject.

North America Doesn’t Need China’s Rare Earths

Thanks to the emergence of REE producers in the Western hemisphere and the growth in the number of advanced-stage REE development projects, Lifton saw the Rest of the World as being ready-and-able to meet its supply needs for rare earth elements.

Indeed, in a subsequent interview, Lifton didn’t even see Chinese policies aimed at reducing global dependence on its REE as being punitive in nature.

My thinking about this has evolved. I think that the Chinese want this to happen [less dependence]. The Chinese are now restructuring their REE production industry and downsizing it to match their internal demand. They will grow the industry in the future, but only to meet their domestic demand. I do not believe that the Chinese are interested in the REE export business.

And that interview was in 2013 – a full decade ago. Flash forward to 2023 and only now do we see China imposing mild restrictions on its exports of REE.

A potential “crisis” is becoming an investment opportunity. For North American-based mining companies, the global market for REE is a tempting target.

China has traditionally attached substantial export duties to its REE exports. If Lifton’s premise is correct and China wants to reduce its global market share of REE, then it is unlikely to relax its export duties as new competitors enter the marketplace.

This translates into the potential for strong margins for North American-based companies that are either already going into production of REE, or have advanced-stage projects which can be moved to production expeditiously.

Enter Appia Rare Earths and Uranium Corp.

Enormous opportunity in rare earths and uranium

When Investor Brands Network sat down for a chat with President Stephen Burega and the Appia management team, two factors immediately shone through: the quality of Appia’s rare earths and uranium assets, and the value opportunity for investors.

Appia doesn’t merely offer investors one project with enormous potential upside. The Company boasts three such projects.

Elliot Lake Uranium & REE Project

This is Appia’s most advanced project to date.

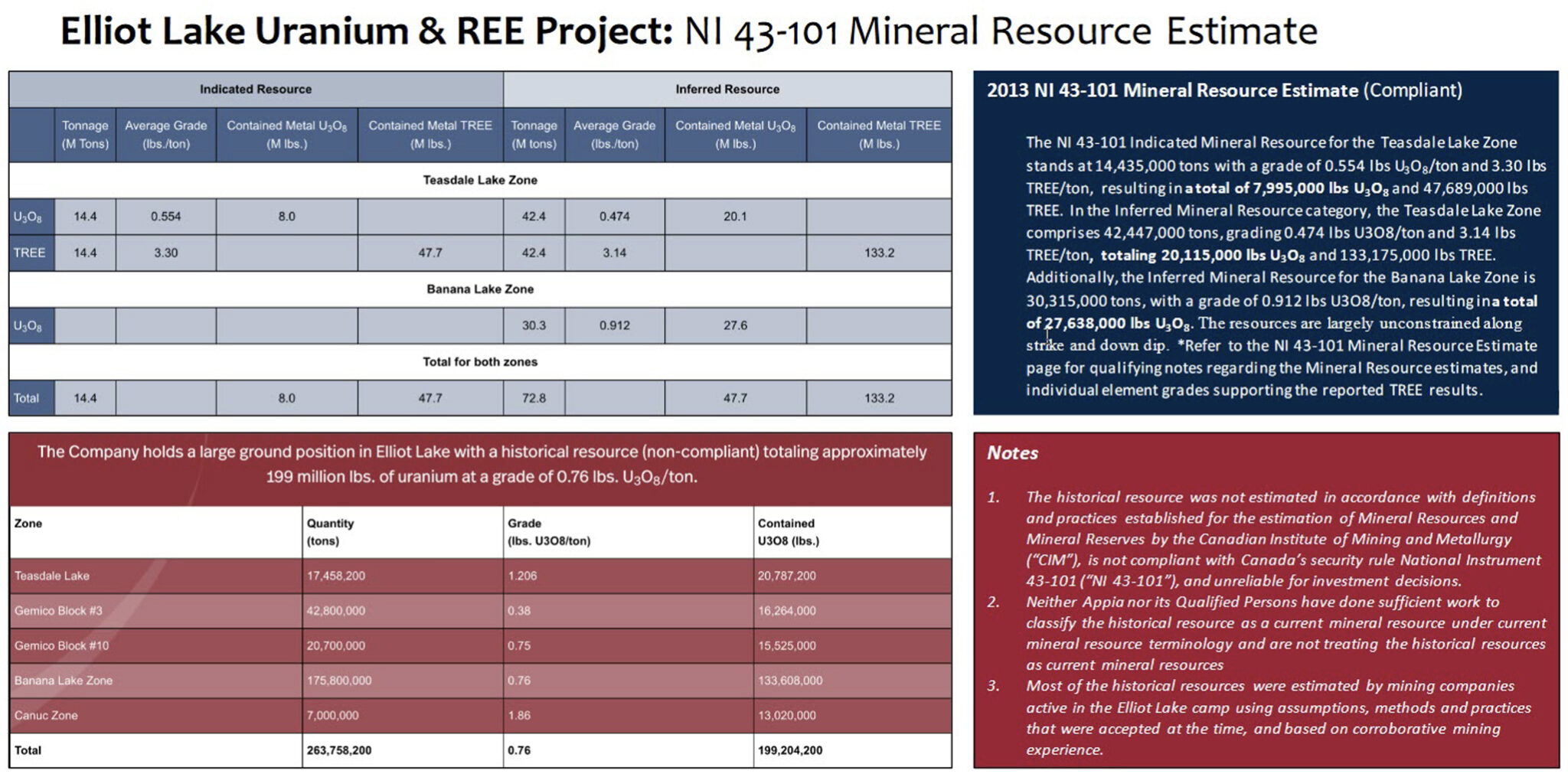

Elliot Lake is a 13,008 hectare property, with a 100% interest held by Appia. It is located in the Elliot Lake uranium camp that has already produced over 300 million pounds of U3O8.

Elliot Lake has a large, high-grade uranium resource. This is comprised of 8.0 million pounds of U3O8 in the Indicated category (Teasdale Zone), with an average grade of 0.554 lbs/ton U3O8.

The Company also has 47.7 million pounds lbs of U3O8 in the Inferred category. This is split between the 20.1 million pounds from the Teasdale Zone (average grade 0.474 lbs/ton U3O8) and 27.6 million pounds from the Banana Zone, with an average grade of 0.912lbs/ton U3O8.

Note that a historical resource estimate for Elliot Lake (not NI 43-101 compliant) reported a contained U3O8 resource of 199.2 million pounds. This indicates a strong possibility for substantial U3O8 resource expansion at Elliot Lake.

With the uranium sector red-hot at the moment, Investor Brands Network is planning an upcoming feature article focusing on the big uranium opportunity at Elliot Lake.

However, where you find uranium mineralization you will also often find REE mineralization as well. The Elliot Lake resource estimate contains even larger rare earths resources.

The NI 43-101 rare earths resources at Elliot Lake total ~180 million pounds: an Indicated resource of 47.7 million pounds with an average grade of 3.30 lbs/ton TREE (total rare earth elements), and 133.2 million pounds of Inferred resource with an average grade of 3.14 lbs/ton TREE.

Which of the rare earths are present in the Elliot Lake resources? Just about all of them. Elliot Lake contains 15 of the 17 different rare earth elements.

The Alces Lake REE Project is a 14,334 hectare project (100% interest) one of five properties held by Appia in Canada’s prolific Athabasca Basin of northern Saskatchewan.

While the Athabasca Basin is primarily known for its world-class uranium deposits, this region is also highly prospective for rare earths exploration. The REE grades in monazite at Alces Lake can only be described as “world class” as well.

Previous drilling has revealed widths of REE mineralization of up to 19 meters. High-grade intercepts include:

- 6.99 meters of 11.70% TREO (total rare earth oxides) including 3.67 meters of 15.81% TREO

- 8.98 meters of 9.46% TREO, including 0.87 meters of 17.1% TREO

However, it’s not only the outstanding grades at Alces Lake that will be of interest to investors.

The Company has discovered multiple zones of shallow and near-surface REE mineralization, in some cases less than 15 meters from the surface. If the Company can unlock a potential open-pit REE resource at Alces Lake, this would greatly improve the Project’s commercial upside.

Then there is the SRC state-of-the-art Monazite/REE Processing Facility that is being constructed in northern Saskatchewan, proximate to the Alces Lake Project.

The Saskatchewan Research Council (SRC) is a provincial business development agency that sees a major future for Saskatchewan not only in REE mining but also rare earths processing. The facility being constructed near Alces Lake is its first step in executing on this plan.

For the SRC, the high grades of REE in monazite at Alces Lake would make this Project ideal for proof-of-concept testing of its processing facility.

PCH Ionic Clay REE Project (Brazil)

Last, but certainly not least, among Appia’s premier REE projects is the PCH Ionic Adsorption Clay deposit. This is a 40,963.18 hectare property, located in Goiás State, Brazil. Appia has an option agreement in place to earn up to a 70% interest over a 5-year horizon.

Here, investors need to immediately focus on two important details: the geology and the jurisdiction.

“Ionic adsorption clay” deposits of REE are the most mining-friendly geology in which substantial concentrations of rare earth elements are hosted. This translates into more economical and efficient development of a rare earths project, from drilling right through to mine construction and mine operations.

Then there is Brazil.

As previously noted, Appia is pleased with the government support from the province of Saskatchewan with respect to its Alces Lake Project. But the Company is thrilled by the commitment of Brazil’s government to support the development of its own rare earths industry.

Talk is cheap. Brazil’s government has already committed 5 billion reals in advancing an REE industry.

All of these factors made the PCH Ionic Clay deposit a very exciting REE prospect for Appia Rare Earths and Uranium. Then came the Company’s latest drill results, released on November 28, 2023.

“An unprecedented zone of high-grade mineralization.” Match that with the mining-friendly ionic adsorption clays of the PCH Project and what do you have? A game-changer.

This comprehensive drill campaign lays the groundwork for a maiden Mineral Resource Estimate (MRE) and an NI 43-101 report, presently in progress.

InvestorBrandNetwork will delve into these spectacular drill results and the PCH Project in much greater detail in an upcoming full-length feature. We’ll also take a closer look at Alces Lake and Elliot Lake, the Company itself, and Appia’s near-term plans for project development.

NOTE TO INVESTORS: The latest news and updates relating to APAAF are available in the company’s newsroom at https://ibn.fm/APAAF

About MiningNewsWire

MiningNewsWire (“MNW”) is a specialized communications platform with a focus on developments and opportunities in the Global Mining and Resources sectors. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, MNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, MNW brings its clients unparalleled recognition and brand awareness.

MNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from MiningNewsWire, text “BigHole” to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.MiningNewsWire.com

Please see full terms of use and disclaimers on the MiningNewsWire website applicable to all content provided by MNW, wherever published or re-published: https://www.MiningNewsWire.com/Disclaimer

MiningNewsWire

Los Angeles, CA

www.MiningNewsWire.com

310.299.1717 Office

Editor@MiningNewsWire.com

MiningNewsWire is powered by IBN